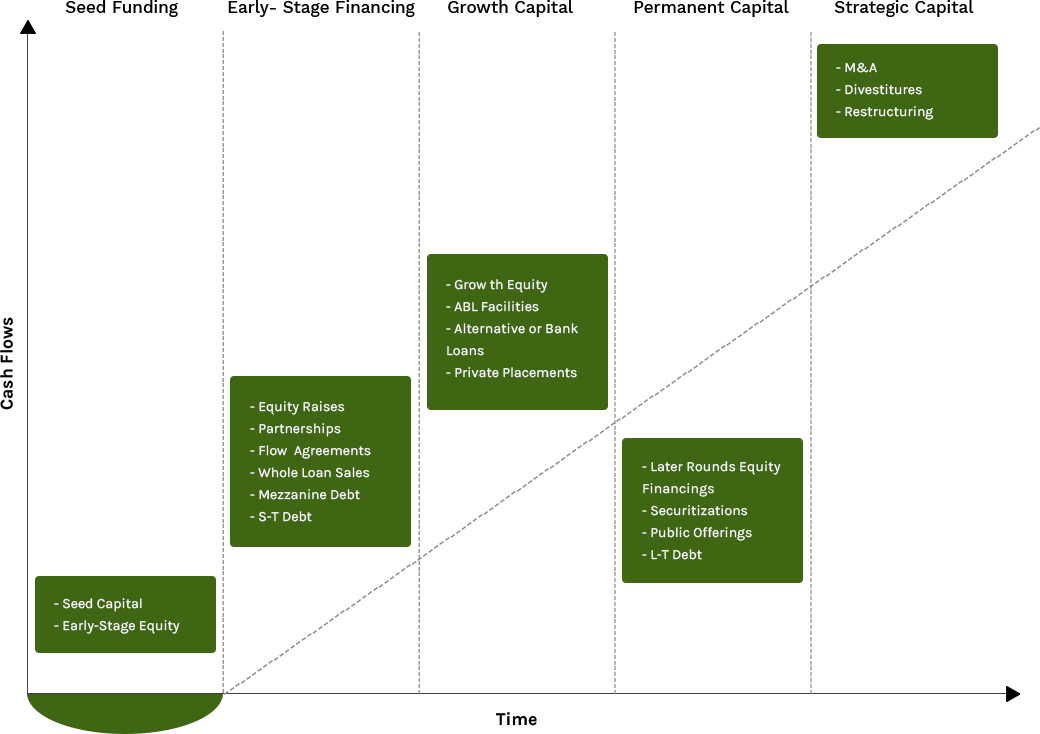

SME Funding Timeline

QueensGiant has the resources and the ability to guide your company through all

stages of the funding timeline and SME lifecycle

| Amount | 100K–$5mm | $500K–$20mm | $5mm–$200mm | $50mm–$5bn | Varies |

| Investor Types |

|

|

|

|

|

Phases of the Transaction Process

Due Diligence

- Working with management to construct and review the loan tape to project loan losses,loan loss curves, and loan level IRR inclusive of scenario analysis.

- Preparing financial analyses and other requested in formation and setting up an electronic data room to manage and monitor distribution of confidential materials.

- Develop a loan stratification and pool analysis.

- Performing integrity check on loan tape.

Positioning

- Reviewing and modeling potential benefits of current funding program.

- Identifying and approaching potential funding partners for the Company while simultaneously pricing versus existing deals in themarketplace.

- Conducting an abbreviated market check, reaching out to a few additional potential credit facility providers to gauge their interest.

Marketing

- Preparing investment teaser, offering documents and distributing to potential funding partners.

- Assisting the Company with crafting preliminary, non-binding indications of interest for additional credit facilities.

Marketing

- Distributing investment teaser and offering documents to potential funding partners.

- Loan modeling, stratification and analysis for pool cut.

- Structuring cash flows for credit facility structure.

- Participating in management meetings and site visits and interacting with target potential capital providers

Finalizing Confidentiality Agreements

- Assisting in negotiations of the financial terms and structure of a funding facility with the selected counterparty

- Reviewing, evaluating and negotiating proposals from each interested party.

- Coordinating with your attorney with respect to documentation and closing of the transaction.

Dedicated transaction and analysis team

Due Diligence

- Arrange buyer/investor visits & due diligence

- Substantial focus on quick turnaround of financial and other data

- Proactively address any issues and concerns

- Hold management presentations

- Facilitate data room access

Close Coordination

- Close coordination with company counsel and accountants

- Ensure requirements and timetables are well adhered to

- Constant contact with buyers/investors

- Early identification of potential buyer's/investor's constraints

- Conduct site visits

- Distribute draft agreements of sale & final bid procedures letter

- Solicit final bids

Experienced senior execution professionals throughout the process

Negotiations & Financing

- Eliminate surprises in the process by anticipating issues prior to negotiating

- Evaluate final bids

- Refine list of stategic buyers/investors

- Negotiation of terms with one or more selected buyers/investors on an accelerated timetable

- Sign definitive agreement

Experienced senior execution professionals throughout the process

Closing

- Tight control over all elements of the process to keep closing on track

- Communicate with employees & customers

- Obtain necessary regulatory approvals if applicable

- Close transaction